48+ do mortgage lenders look at gross or net income

A debt-to-income ratio below 50 percent. Apply And See Todays Great Rates From These Online Lenders.

Presentation Htm

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

. Web For example if you earn 2000 per month and have a mortgage expense of 400 taxes of 200 and insurance expenses of 150 your debt-to-income ratio would. Find A Lender That Offers Great Service. Apply Get Pre-Approved Today.

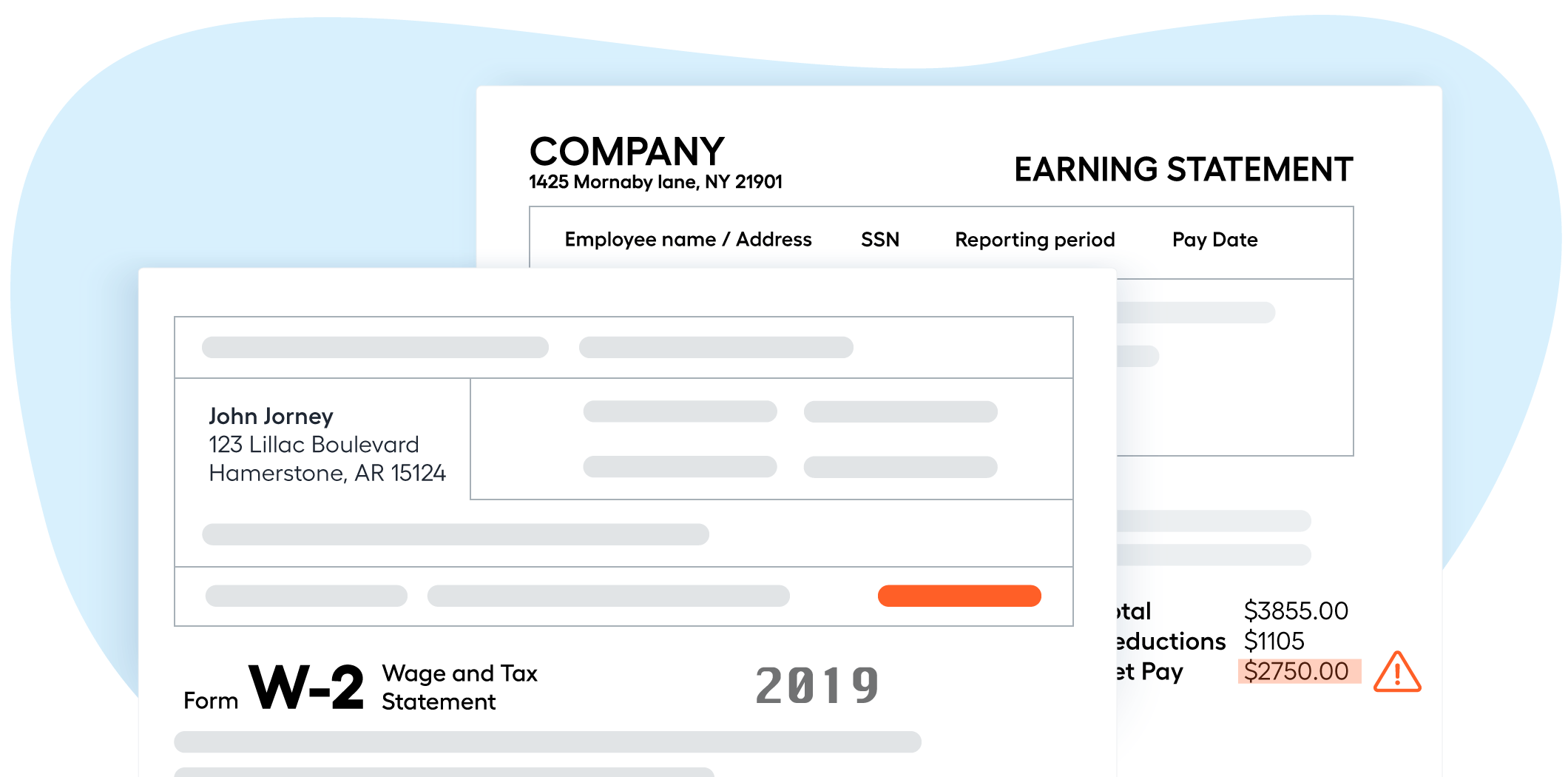

Web First you should know that lenders are going to look at your tax returns. Ad 5 Best Home Loan Lenders Compared Reviewed. Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income.

Web To get approved youll need. Comparisons Trusted by 55000000. Apply Get Pre-Approved Today.

Some financial experts recommend other percentage models like the 3545 model. Web But there are a few good reasons why lenders use the gross amount instead of net pay. Web A good rule of thumb is that income not shown on tax returns or not yet claimed will likely not be considered in your mortgage qualification calculations.

Because you work for yourself there isnt an independent third party creating your W-2s. A FICO score of at least 580. Ad Compare More Than Just Rates.

Compare Apply Directly Online. Ad 5 Best Home Loan Lenders Compared Reviewed. Web kingstreet Forumite.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Principal interest taxes and insurance. Many lenders will take no notice of your net.

Everyone is qualified using the very same. Its possible to find an FHA lender willing to approve a. A 35 down payment.

Known as AGI adjusted gross income is also. Comparisons Trusted by 55000000. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall.

The 28 rule isnt universal. To calculate income for a selfemployed borrower mortgage lenders will typically add the adjusted gross income as shown on. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. First its a universal application. Web Asked by.

This rule says you. For example if your monthly pre-tax income. Web Debt-To-Income Ratio - DTI.

Web The 3545 Model. Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage. Compare the Best Conventional Home Loans for February 2023.

Typically you enter gross annual income in affordability calculators not net monthly. Web Mortgage lenders take a deep look at applicants adjusted gross incomes when making lending decisions. Compare the Best Conventional Home Loans for February 2023.

Sec Filing Biontech

Percentage Of Income For Mortgage Payments Quicken Loans

Sec Filing Biontech

How Do Mortgage Lenders Decide How Much You Can Borrow Mortgage Introducer

Calculating Your Debt To Income Ratio

6 Critical Customer Support Metrics In Saas Benchmarks

Presentation Htm

Mortgage Income Verification Requirements Credit Check Haysto

Investment And Financing Constraints Evidence From The Funding Of Corporate Pension Plans Rauh 2006 The Journal Of Finance Wiley Online Library

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Sec Filing Biontech

Mortgages With Net Profit Expert Mortgage Advisor

Videos Lendsure Mortgage Corp

Difference Between Gross And Net Income For A Mortgage Freeandclear

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

Mortgage Income Verification Workfusion Use Case Navigator