Rental real estate depreciation calculator

Three factors help determine the amount of Depreciation you must deduct each year. This is known as the breakeven year.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Dataspot Analytics LLC is.

. The first is that investors earn regular cash. Divide the base by the recovery time to get the amount depreciated each year. Depreciation in real estate is.

The basis of a real estate asset is defined as the total amount paid to acquire the property. Ad We Can Help You Bring In Prospective Tenants Too With Our Free Rental Listings. It provides a couple different methods of depreciation.

For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970. The whole amount is 126000. This depreciation calculator is for calculating the depreciation schedule of an asset.

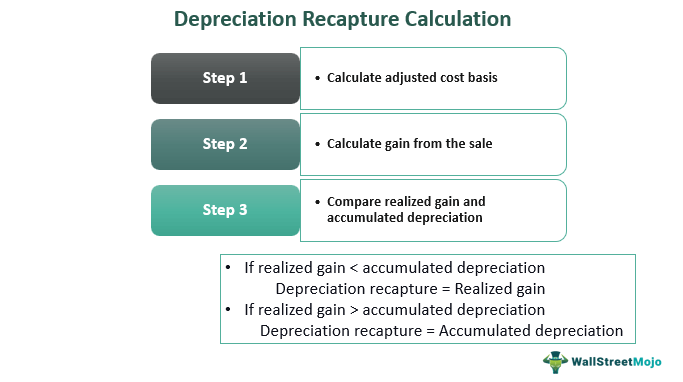

This mortgage calculator is. For example Marks property is for 150000. Depreciation recapture example for a commercial rental property held for five years with a.

How This Calculator Works. If youre an experienced rental property owner who benefited from depreciation be aware that the IRS might want some of that money back when you sell. Calculate 90 percent of 140000 to get the rentals base.

There are several ways in which rental property investments earn income. 100000 cost basis x 1970 1970. Total Int As given.

Rental properties are known to yield. Total Int No pre-payment. Your basis in your property the recovery.

It could be three years or seven or 15. The Rental Property Calculator can help run the numbers. Multiply annual depreciation expense by number of years the property was held.

Most of the calculations in this rental property calculator get projected over 30 years. A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. How The Cap Rate Calculator Works.

After entering data a simplified income statement balance sheet and. First one can choose the straight line method of. How to Calculate Depreciation in real estate.

When in other words do the long-run costs of renting begin to outweigh the upfront costs of buying. Find cap rates for rental housing throughout the United States. Step 1 Determine the Cost Basis.

To calculate the ROI of a property take the estimated annual rate of return divide it by the property price and then convert it into a percentage. Rentometer Is an Easy Way To Compare Your Rent With Other Local Properties.

How To Calculate Depreciation Expense For Business

Depreciation Recapture Meaning Calculation Tax Rate Example

Rental Property Depreciation Rules Schedule Recapture

Straight Line Depreciation Calculator And Definition Retipster

Rental Property Depreciation Rules Schedule Recapture

Depreciation Schedule Formula And Calculator Excel Template

Macrs Depreciation Calculator Irs Publication 946

Straight Line Depreciation Calculator And Definition Retipster

Real Estate Depreciation Meaning Examples Calculations

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator

How To Calculate Depreciation On A Rental Property

How To Calculate Depreciation On Rental Property

Macrs Depreciation Calculator With Formula Nerd Counter

How To Use Rental Property Depreciation To Your Advantage

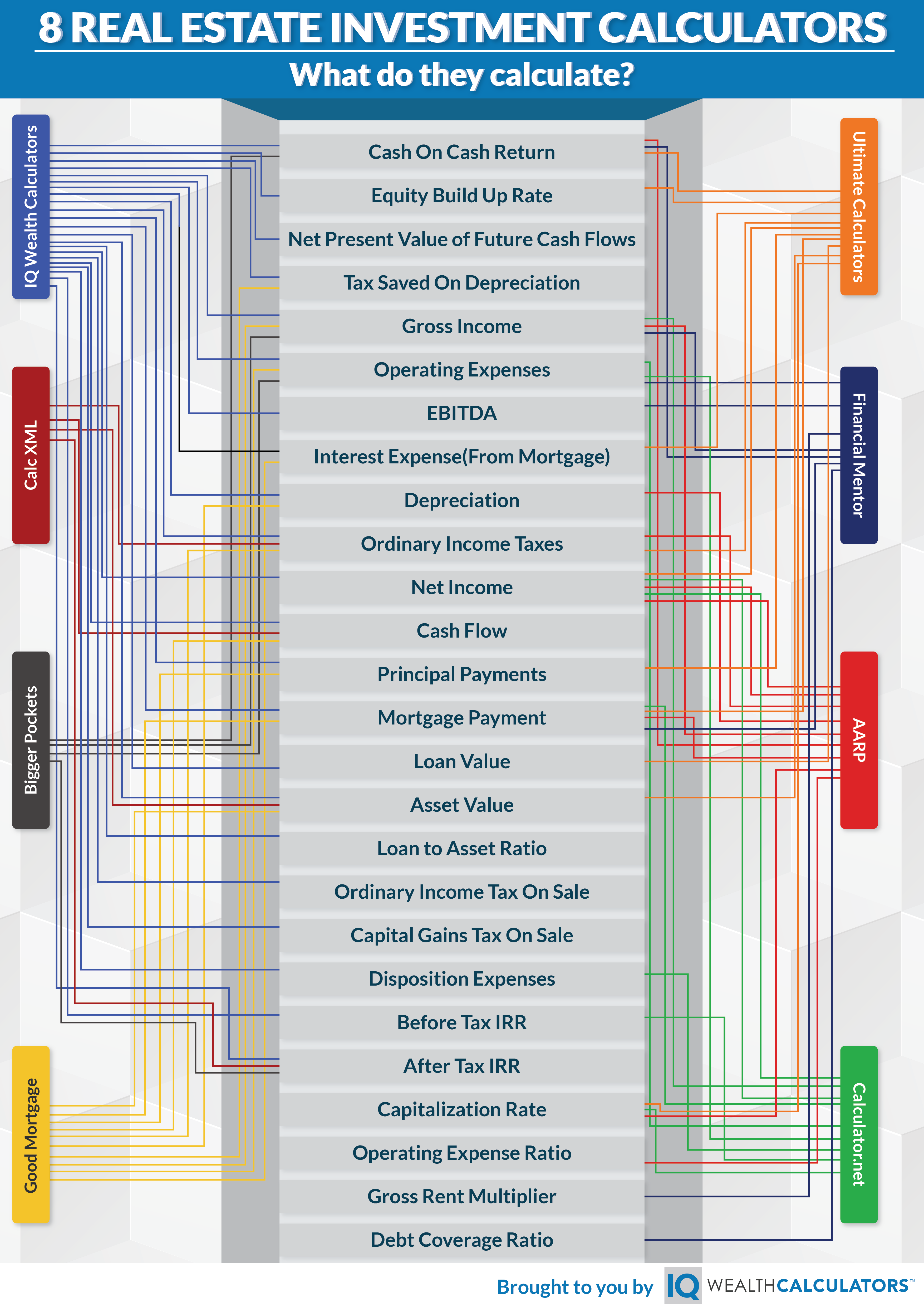

8 Powerful Real Estate Investment Calculators A Full Review

Depreciation For Rental Property How To Calculate